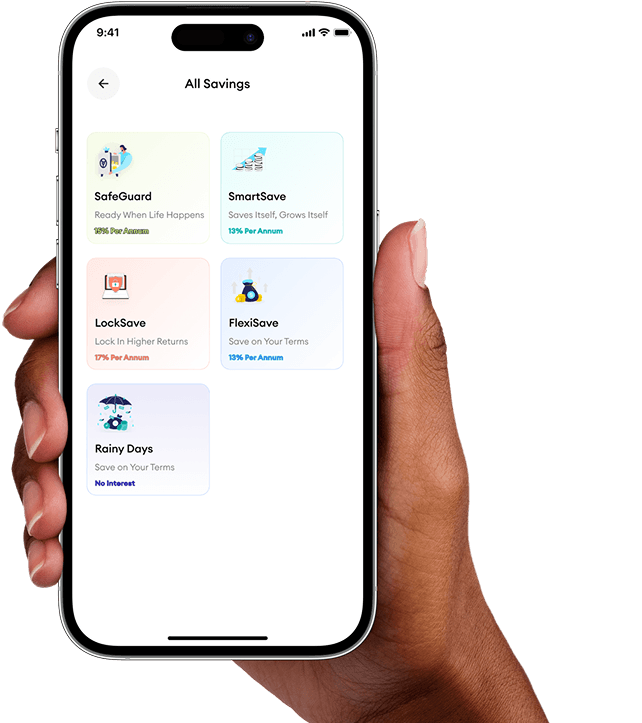

Choose from 5 tailored savings plans designed for your lifestyle. From daily flexibility to high-yield locking, earn up to 20% ROI.

Trusted by 10,000+ Savers in Nigeria

For the disciplined saver. Lock your funds away for a set period and get rewarded with our highest interest rates paid upfront.

Emergencies don't announce themselves. Keep a dedicated stash for life's surprises with steady returns and quick access.

Life is unpredictable. Enjoy the freedom to withdraw whenever you need while your money works for you daily.

Plain and simple capital preservation. A no-frills place to park cash you might need instantly.

Put your savings on autopilot. We deduct small amounts based on your schedule so you save without feeling the pinch.

Can’t find the answer you’re looking for? Reach out to our customer support team.

Thamani Invest is a platform designed to help you grow your wealth through intelligent, data-driven investment strategies and secure savings plans tailored to your financial goals.

We only charge a small fee for funding your wallet. As this is charged by our partners, your investment itself is fee-free.

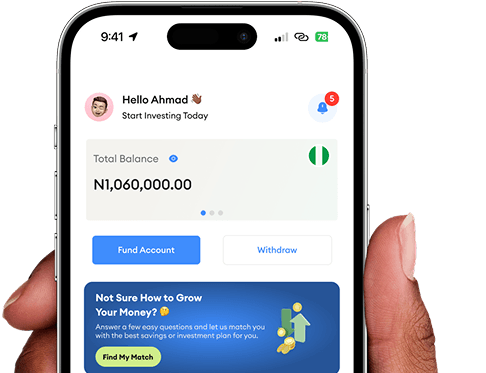

You can deposit funds easily via bank transfer, USSD, or debit card. Simply navigate to your wallet in the app, select 'Fund Account', and follow the prompts.

All investments carry risk. However, because we specialize in fixed-term investments, we can provide a guaranteed return upon the completion of the term. We also diversify portfolios to mitigate market volatility.

Currently, you can only have one primary user account, but within that account, you can create multiple 'Plans' (e.g., a Savings Plan, an Education Fund, and a Retirement Portfolio) to track different goals separately.

Secure, regulated, and backed by innovative AI guidance—build inflation-proof savings and investments with Thamani.